Property Overview

| Category | Property overview |

|---|---|

| Address | 10550 Ella Blvd, Houston, TX 77067 |

| Land Area | 68.87 Acres |

| Lease Area | 856,605 SF |

| Building Coverage Ratio | 28.6% |

| Parking Spaces | 2,667 spaces for vehicles / 189 spaces for trailers |

| Tenant | Amazon.com Services, Inc. (Lease guarantee: Amazon.com Inc) |

| Lease Commencement | July 15, 2017 |

| Lease Expiry | July 31, 2032 |

| Extension Options | Four 5-year extensions available (maximum expiry on July 31, 2052) |

| Lease Type | NNN (tenant is responsible for property taxes, maintenance fees, and insurance premiums) |

| Rent Increase | 1.50% annually |

| Early Termination Clause | None |

Regional Analysis (Macro)

Houston, TX: Investing in a Major City in the Rapidly Growing Sun-Belt Region

Located in Texas, which is known for its mild climate and business-friendly environment, Houston is attracting a growing population and wealth.

·The second most populous state in the United States (approximately 30 million people as of the end of 2023), which saw a growth of 18.9% from 2010 to 2023.

·Texas attracts businesses by eliminating personal income tax and implementing corporate-friendly deregulation policies.

·The state's relatively low land use regulations allow companies to quickly establish production facilities, making it a preferred location for businesses.

Houston, the largest city in Texas, has consistently recorded steady population growth.

·Houston has a population of 2.32 million, making it the fourth-largest city in the United States and the largest in Texas. From 2010 to 2023, it experienced a significant growth rate of 11.0%.

·Based on a diversified industrial structure including trade/transportation, healthcare, tourism, and manufacturing, Houston achieved a low unemployment rate of 3.6% as of the end of 2019. Despite an increase in unemployment due to COVID-19, it has rapidly recovered, recording an unemployment rate of 3.8% as of April 2024.

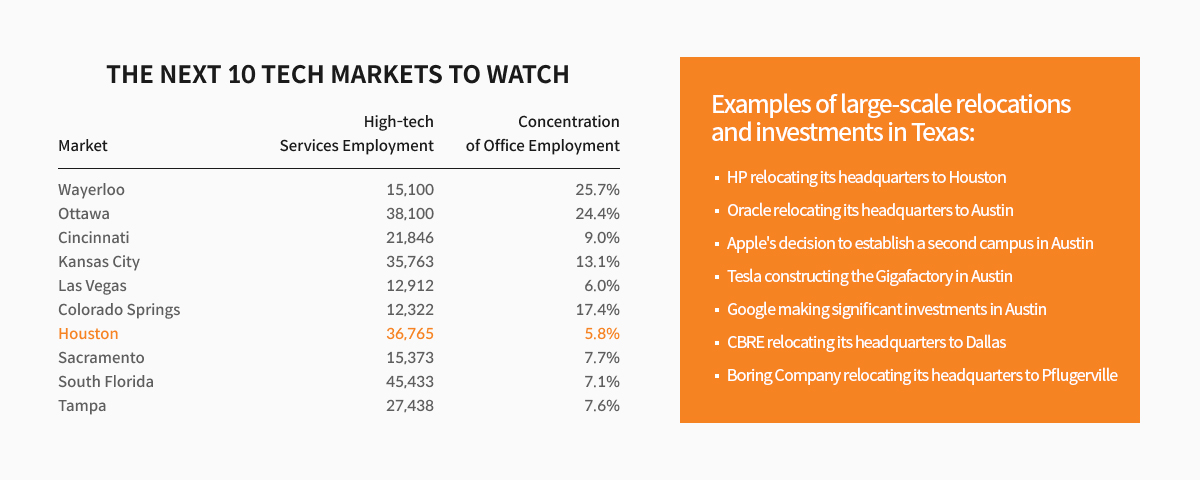

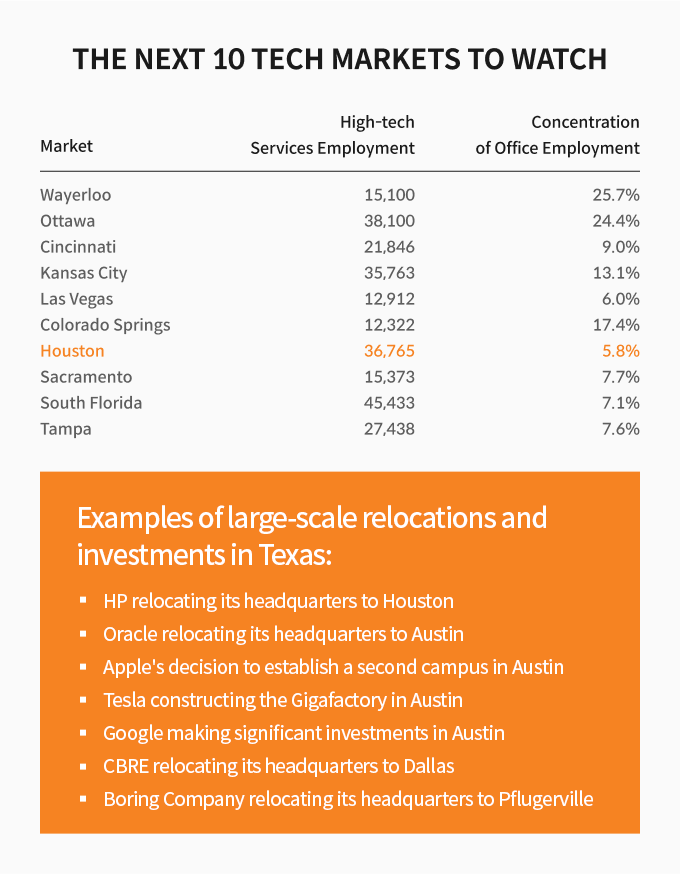

As one of the preferred destinations among major companies for relocation, attracting investments from US investors.

·Continued demand for regional office openings and expansions by global corporations and small to medium-sized tech firms.

·Fortune 500 companies like HP, Oracle, and Tesla completed relocations (2020).

·Over the past three years, approximately 20 companies have relocated, including Boring Company, an industrial firm owned by Elon Musk, and SpaceX (2022); West Wood, an investment firm with assets totaling $22 trillion (2023); and Q5iD HQ, a tech company specializing in facial recognition technology (2023).

·With various growth factors like these, Texas has been selected as one of CBRE's Next 10 Tech Markets.

Source: CBRE/JLL Research, US Census Bureau, Moody’s Analytics, Maeil Business Newspaper, Office of the Governor(Texas)

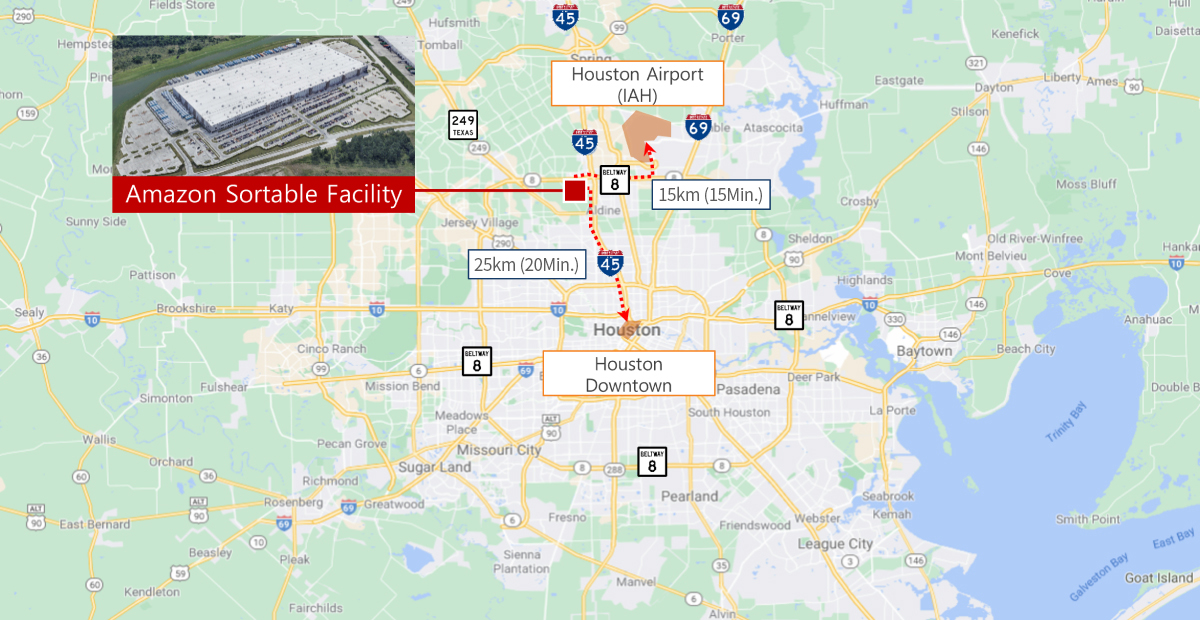

Location Analysis (Micro)

A Sortable Fulfillment logistics asset with excellent accessibility to transportation:

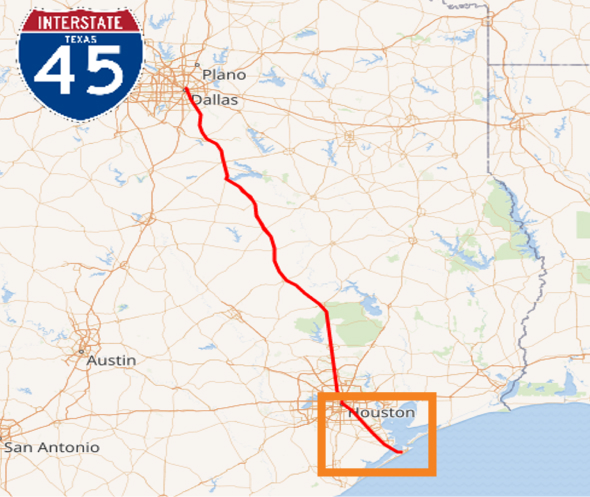

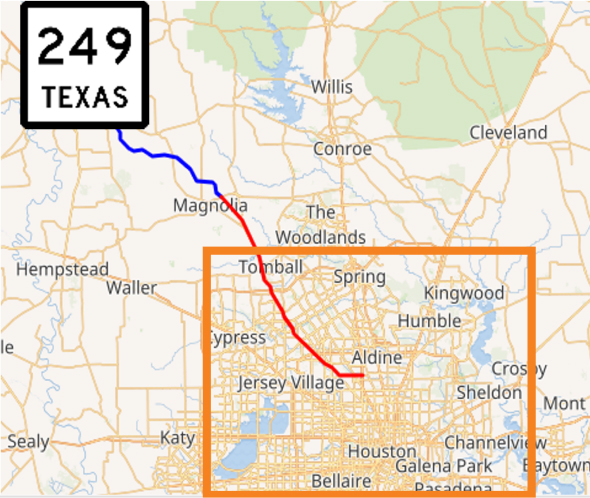

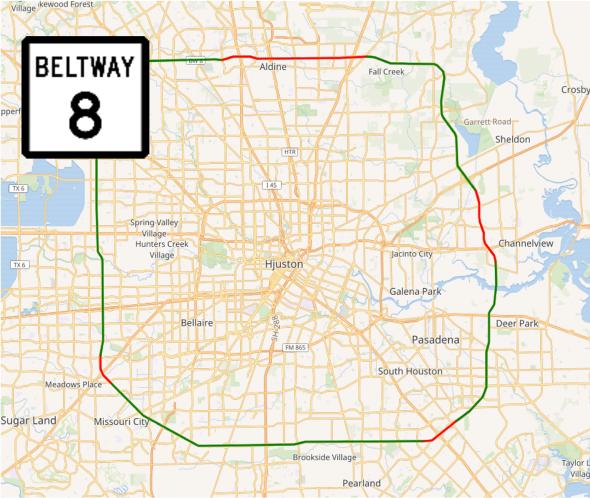

·The property is located adjacent to the I-45 highway, which connects inland Texas (towards Dallas) and is in close proximity to the I-69, traversing the Midwest and Northeast of the United States, ensuring exceptional accessibility.

·From the property to downtown Houston, it's approximately 25km (20 minutes by car), and to Houston International Airport, it's around 15km (15 minutes by car), making it a prime location for a logistics hub.

Tenant Overview

Amazon, the world's largest e-commerce company, with a credit rating of AA (S&P), has entered into a long-term lease.

·Amazon is the world's largest e-commerce and cloud computing company, with a market capitalization of approximately $1.9 trillion and a credit rating of AA (S&P).

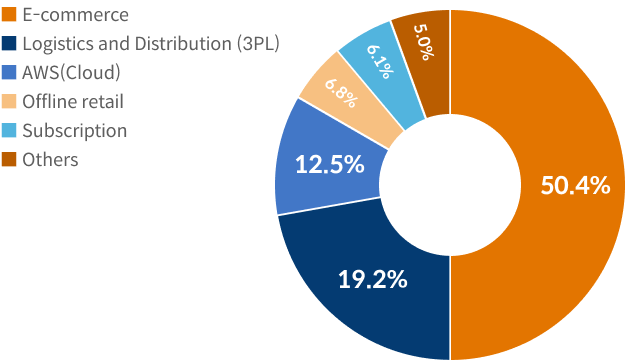

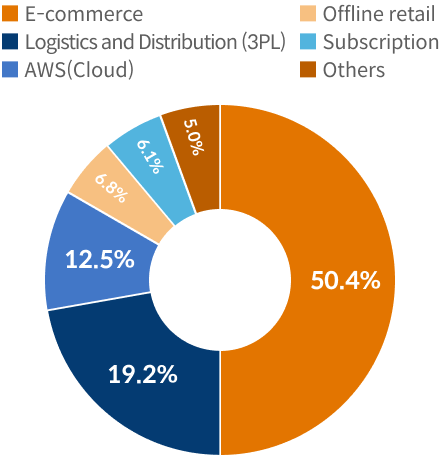

·With diverse revenue streams from e-commerce, third-party logistics (3PL), and the cloud computing division (AWS), Amazon maintains a strong outlook for sustained growth through business diversification and financial stability.

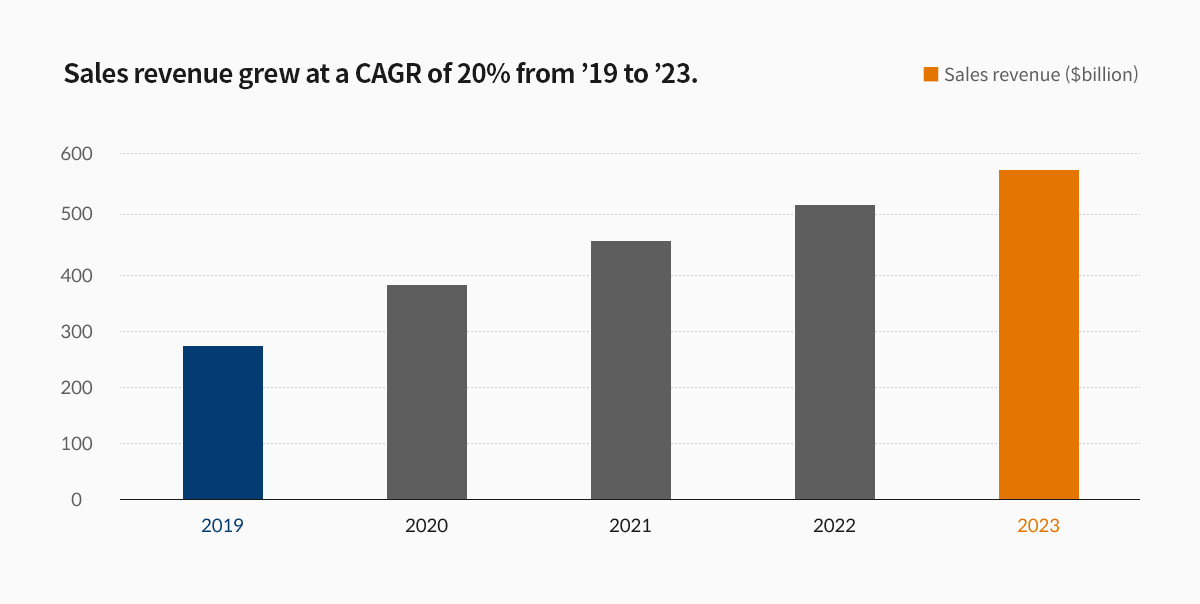

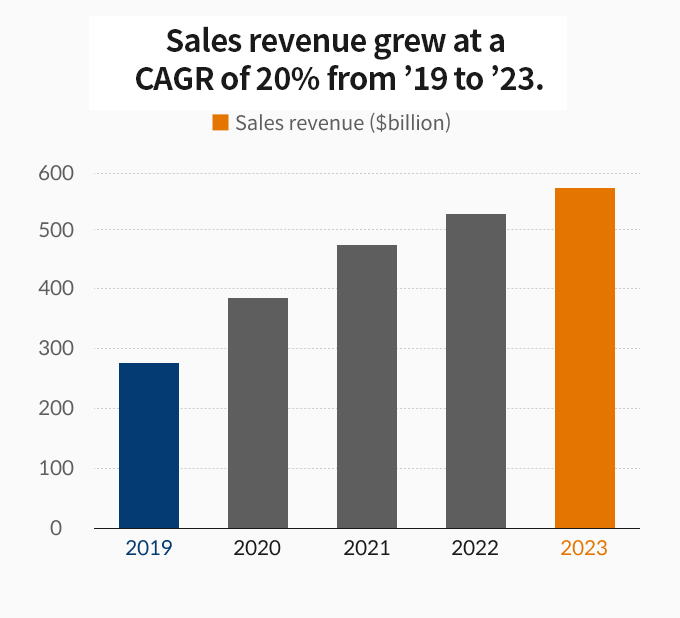

·Amazon has been recording stable growth with a 5-year average CAGR (Compound Annual Growth Rate) of around 20%.

| Category | Content |

|---|---|

| Company Name | Amazon |

| Founding Date | July 1994 |

| Headquarters Location | Seattle, Washington, USA |

| Listed on | NASDAQ (Ticker: AMZN) |

| Market Capitalization | $1.9 trillion (as of May '24) |

| Annual Revenue | $574 billion (As of ’23) |

| Number of Employees | 1,521,000 (as of ’24) |

| Corporate Credit Rating | AA(S&P) |

| Major Business (Revenue Share) |

Source: Amazon Company Filings

| The Key Financial figures for Amazon over the past 5 years. (Unit: $ million) | |||||

|---|---|---|---|---|---|

| Category | 2019 | 2020 | 2021 | 2022 | 2023 |

| Total Assets | 225,248 | 321,195 | 420,549 | 462,675 | 527,854 |

| Liabilities | 163,188 | 227,791 | 282,304 | 316,632 | 325,979 |

| Equity | 62,060 | 93,404 | 138,245 | 146,043 | 201,875 |

| Revenue | 280,522 | 386,064 | 469,822 | 513,983 | 574,785 |

| Operating Income | 14,541 | 22,899 | 24,879 | 12,248 | 36,852 |

| Net Income | 11,588 | 21,331 | 33,364 | (2,722) | 30,425 |

Boasting overwhelming scale and growth potential

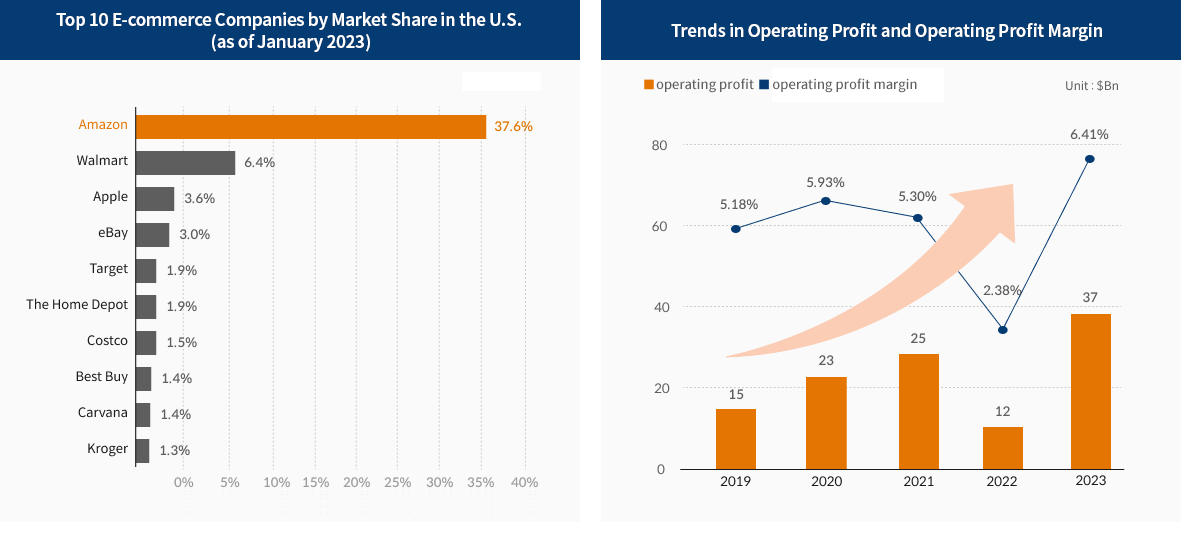

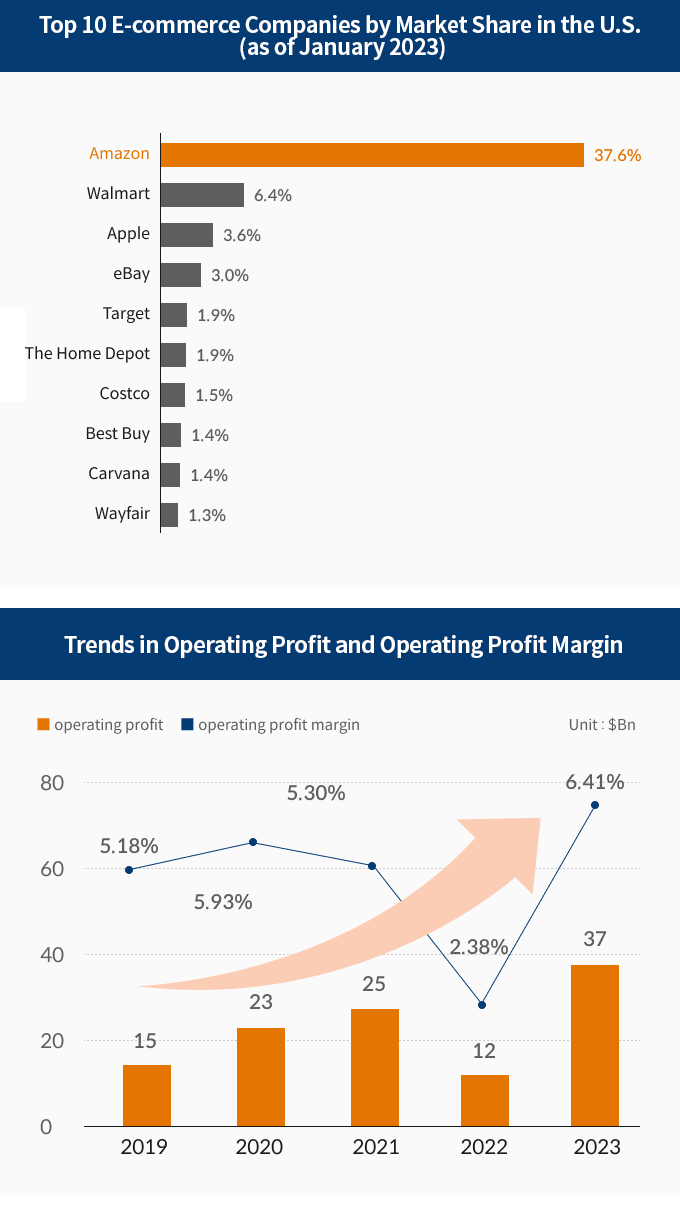

·As of January 2023, Amazon holds a dominant market share of nearly 40% among top e-commerce companies in the United States. This strong position is supported by an extensive logistics infrastructure, which is expected to help Amazon maintain its high market share continuously.

·Although Amazon's operating profit plummeted in 2022 due to factors such as the decline in the stock price of Rivian, the electric vehicle company it invested in, it steadily recovered, achieving an approximately 201% increase in operating profit in 2023 compared to the previous year. Except for 2022, Amazon has consistently maintained an operating margin above 5%, demonstrating excellent financial health.

Source: statista(USA), S&P Global, Amazon IR